How Much Money Does SpaceX Make?

SpaceX is growing faster than just about anybody else. And unlike almost everybody else, it’s making money in space.

SpaceX, the pioneering space company founded by Elon Musk with money made from his PayPal payout more than 20 years ago, has grown to become arguably the most successful space company (or company, period) in the history of mankind. In 2023, SpaceX launched rockets to orbit nearly 100 times, exceeding the performance of every rival on Earth — up to and including the entire nation of China.

But one thing has bugged us from the beginning, and it’s a question that we’ve asked ourselves several times over the years: How profitable is SpaceX?

Today, we find out.

Image source: SpaceX.

Payload Space spills the beans on SpaceX

SpaceX is, of course, a private company. That means you can’t easily invest in the stock (although you can invest in SpaceX indirectly). It also means that the SEC doesn’t require the company to regularly update investors on its profits and losses, so it doesn’t.

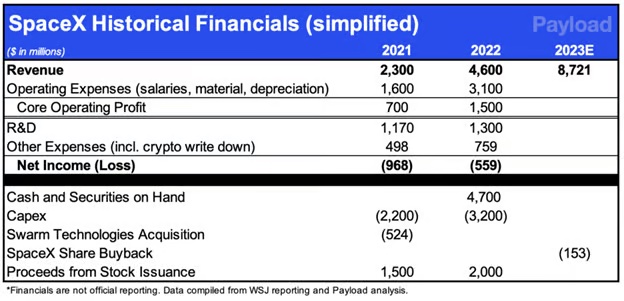

In a report released last month, however, space markets analyst Payload Space put together its “educated best guess” of SpaceX’s finances based on reporting done by The Wall Street Journal and its own analysis. The numbers Payload worked up are not shockingly big — not in the context of more established space stocks that are decades older than SpaceX. For example, according to data from S&P Global Market Intelligence, Lockheed Martin‘s (LMT 1.28%) space division did nearly $13 billion in work last year, while Boeing‘s (BA 0.27%) Defense, Space & Security business (only partly focused on space) approached $25 billion in revenue.

What is kind of shocking, however, is how fast SpaceX is growing relative to those two larger companies. From 2021 to 2023, Lockheed Martin’s space revenue grew barely 6% — and its profits decreased. At Boeing, both sales and earnings declined in the defense and space business. In contrast, at SpaceX, revenues have more than tripled over the last two years, even as the company appears to have flipped from a loss to a profit.

Here. See for yourself (with a hat tip to Payload Research for allowing the reprint):

These numbers may only be guesses. But if Payload is even in the ballpark, SpaceX outgrew its closest rival, Lockheed Martin (which, along with Boeing, owns half of the United Launch Alliance space company) by more than 270% over the last two years. Granted, Payload lacked sufficient information to be certain of how much SpaceX earned on that revenue. But later in the report, Payload says it’s reasonably certain SpaceX’s profits in 2023 were “significant.”

And that makes it basically certain that those profits are, therefore, positive.

How’d they do that?

How did SpaceX flip from losses to profits in the space of just two years? You might think the answer is as simple as “by launching more rockets.” But that wouldn’t be entirely correct.

True, in 2021, SpaceX launched 31 times. True, in 2023, it launched 98 times — more than three times as many flights. But fully 63 of SpaceX’s launches in 2023 were Starlink missions, carrying the company’s own satellites to orbit — and generating essentially no revenue (from the launches, at least) for SpaceX. Flights for paying customers in 2023 increased hardly at all, and certainly not enough to explain a threefold increase in company revenue.

Rather, the reason SpaceX’s revenue tripled through 2023 was what happened once those Starlink satellites reached space and began beaming down internet service to customers. As millions of subscribers began buying Starlink terminals and paying monthly for Starlink internet service, SpaceX’s revenues boomed. In 2023, Payload calculates that SpaceX probably generated $830 million in revenue from selling Starlink terminals to customers and a further $3.3 billion in revenue from providing services through those terminals — $4.2 billion in all.

That’s more money than the $3.5 billion that SpaceX made from launching rockets!

What’s next for SpaceX — and Starlink?

It’s also worth noting that profit margins on providing internet service are much higher than the profit margins on launching rockets. Comcast, for example, reported 37.4% earnings before interest, taxes, depreciation, and amortization (EBITDA) margins on its home internet business. SpaceX has indicated that it will be targeting 60% operating profit margins on Starlink once the business is operating at full scale.

SpaceX may have gotten its start as a rocket company. But as time goes by, and the Starlink satellite internet service continues to vastly outgrow the legacy rockets business, SpaceX will depend more and more on Starlink to drive both revenue growth and a huge growth in profits. The long-term goal, if you’ll recall, is to get the company to $36 billion in revenue over the next few years — which at 60% margins would imply roughly $22 billion in annual operating profit.

That’s great news for SpaceX, and seeing as SpaceX has promised to IPO Starlink in the not-too-distant future, it’s pretty great news for investors hoping to own a piece of Starlink as well.

Should you invest $1,000 in Lockheed Martin right now?

Before you buy stock in Lockheed Martin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lockheed Martin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $504,104!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.